Re: \"Gale Wars\" Articulating loaders

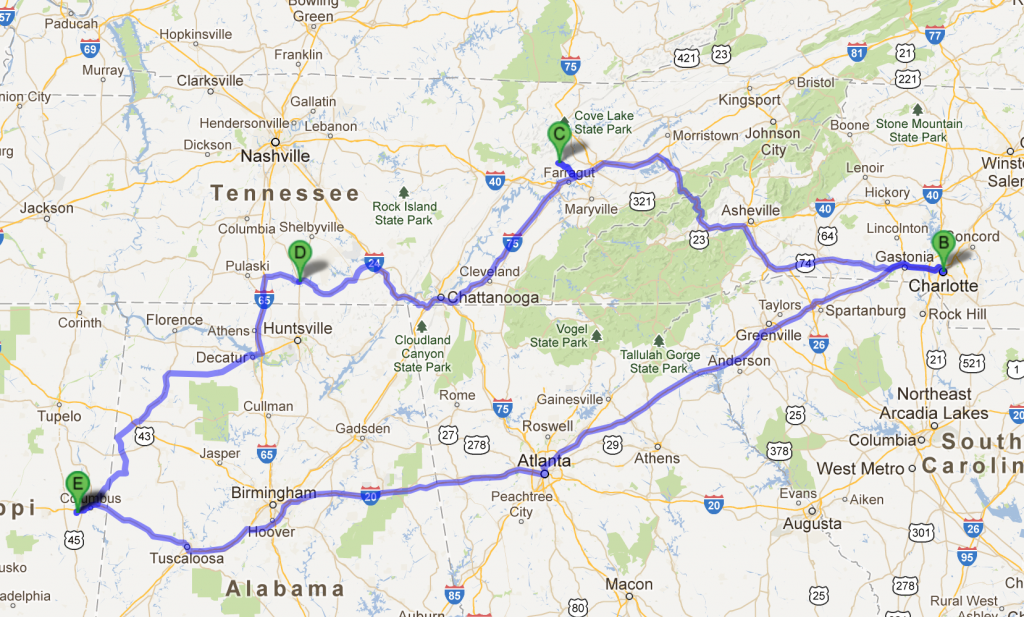

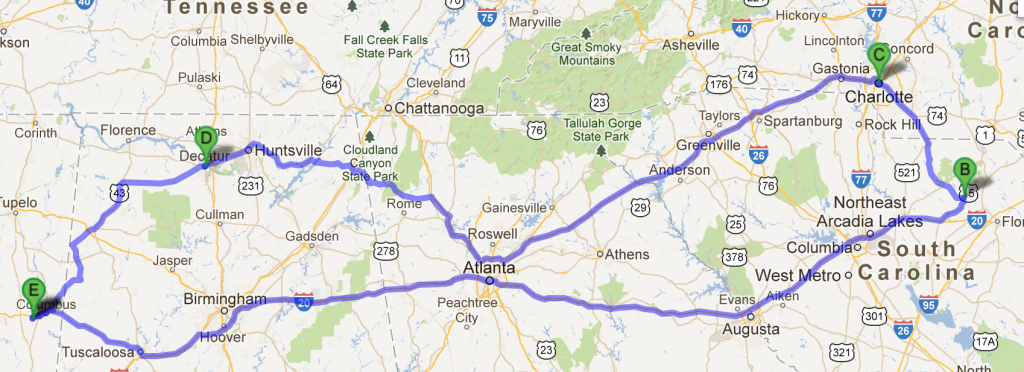

With you being in TN, you're not charged any tax by us for things delivered to you, period. Now, if you buy a trailer from us, your state will charge you tax most likely when you register it. There is a shipping charge, however on a AL540 you're looking at ~4-5% of the price of the machine to get it to TN.

I hadn't considered that aspect of trade in, I've never sold anything inside the state of Minnesota (where the dealership is located). Tax here in MS is 7% or less, and the difference between trade in and resale will nearly always be higher than that by I'd guess a factor of three, excluding if there was already a buyer in place for the equipment that was traded in (quick sale).

In your example, you don't show a difference between trade in price and the retail price you would sell the machine for privately. Also your example fails to illustrate the cost associated with getting your machine to MN to trade it in as well as the above mentioned shipping cost of the new machine.

None of this is intended to come across as a smart alec, only clarification and trying to learn something!